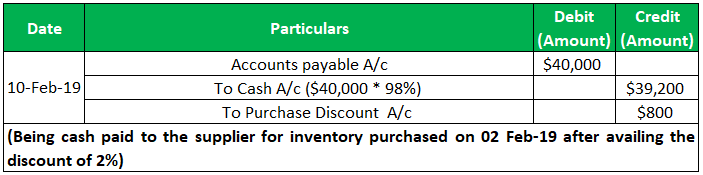

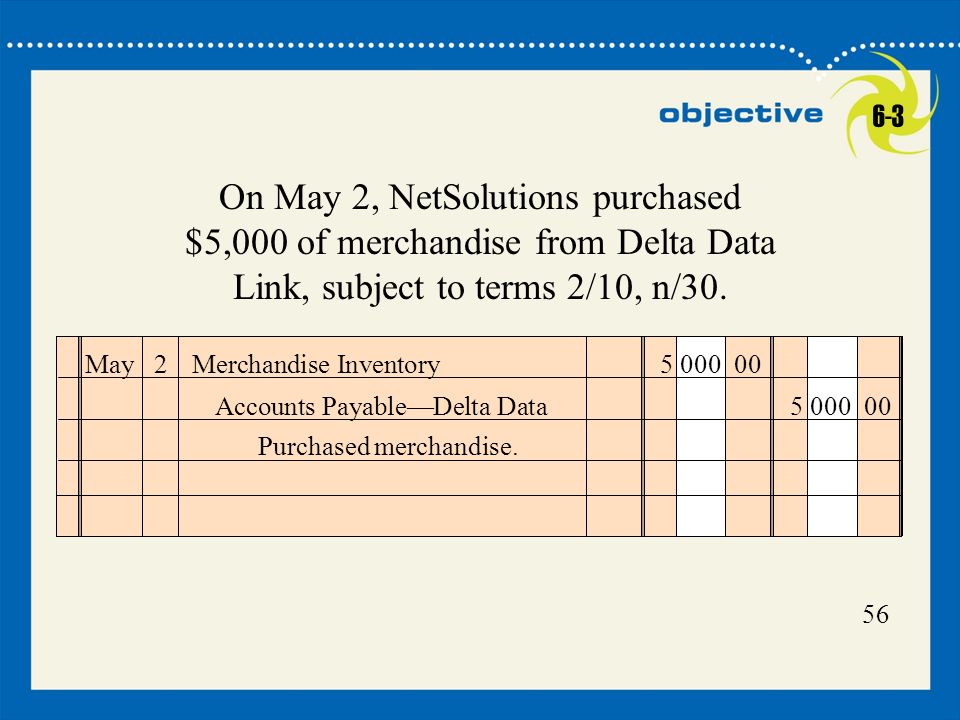

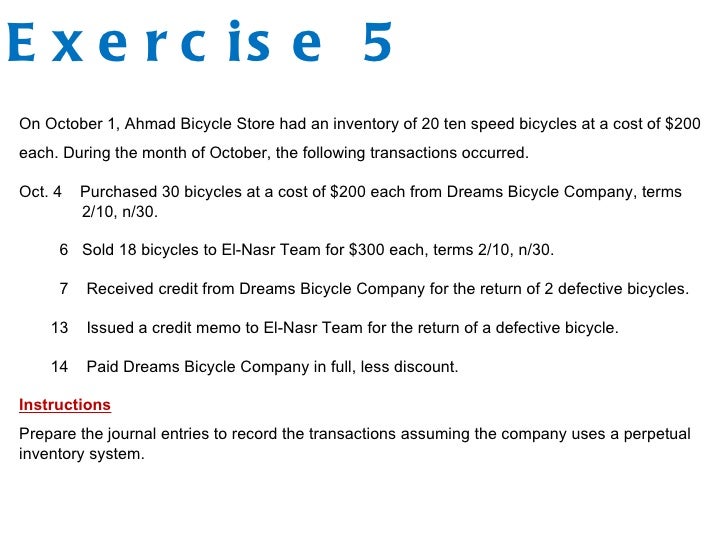

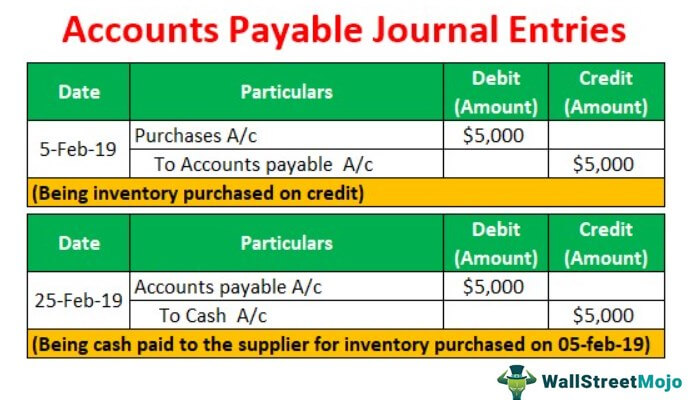

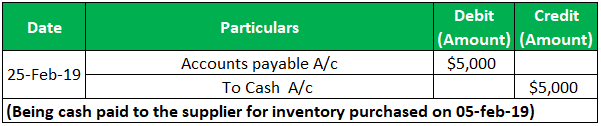

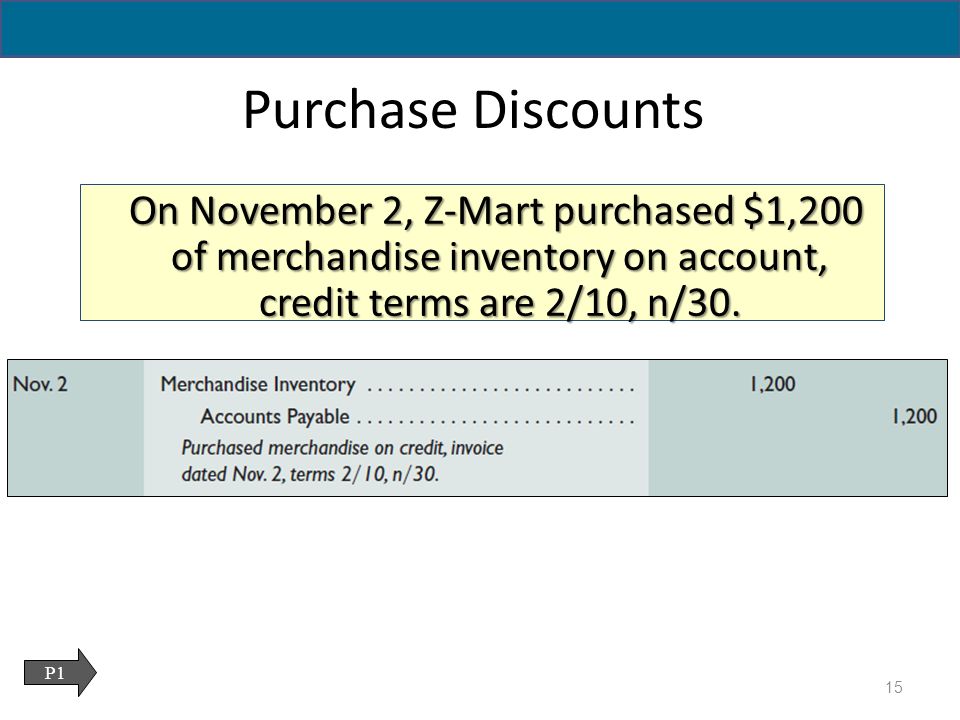

Journalize the following transaction Purchased merchandise from Taco Co, $13,650, terms FOB destination, 2/10, n/30 Account Payable Account Payable is2/10, n/30 If the vendor's invoice has terms of 2/10, n/30, the "2" represents 2%, the "10" represents 10 days, the "n" represents the word net and the "30" represents 30 days This means that the buyer can take an early payment discount of 2% of the amount owed if the amount is remitted within 10 days instead of the customary 30 daysCash discounts are described in credit terms (2/10, n/ 30) A reduced payment applies to the discount period (2/10, can only pay 2% less of principal amount within 10 days) Sellers can grant cash discount to encourage buyers to pay earlier A seller views a cash discount as a sales discount A buyer views a cash discount as a purpose discount

Internal Control Cash And Merchandise Sales Ppt Download

What is 2/10 n/30

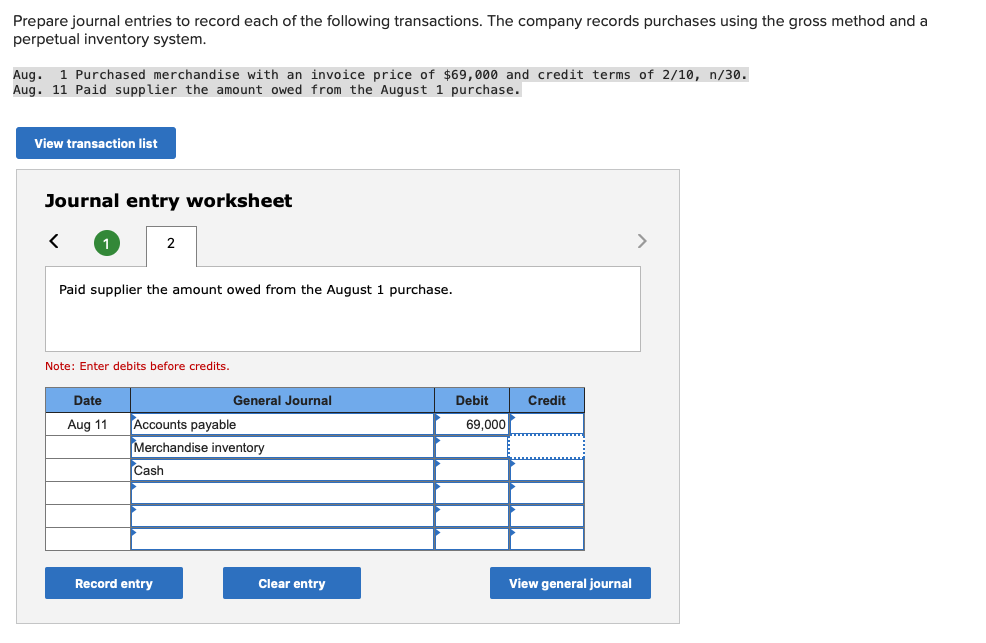

What is 2/10 n/30-Q5 A company purchased $1,800 of merchandise on July 5 with terms 2/10, n/30 On July 7, it returned $0 worth of merchandise On July 12, it paid the full amount due Assuming the company uses a perpetual inventory system, and records purchases using the gross method, the correct journal entry to record the payment on July 12 is2/10, n/30 means that customers will receive 2% discount if they settle accounts receivable within 10 days after the invoice date Customers have 30 days to settle the invoice, however, they will not receive discount if they pay after 10 th day of invoice date

Internal Control Cash And Merchandise Sales Ppt Download

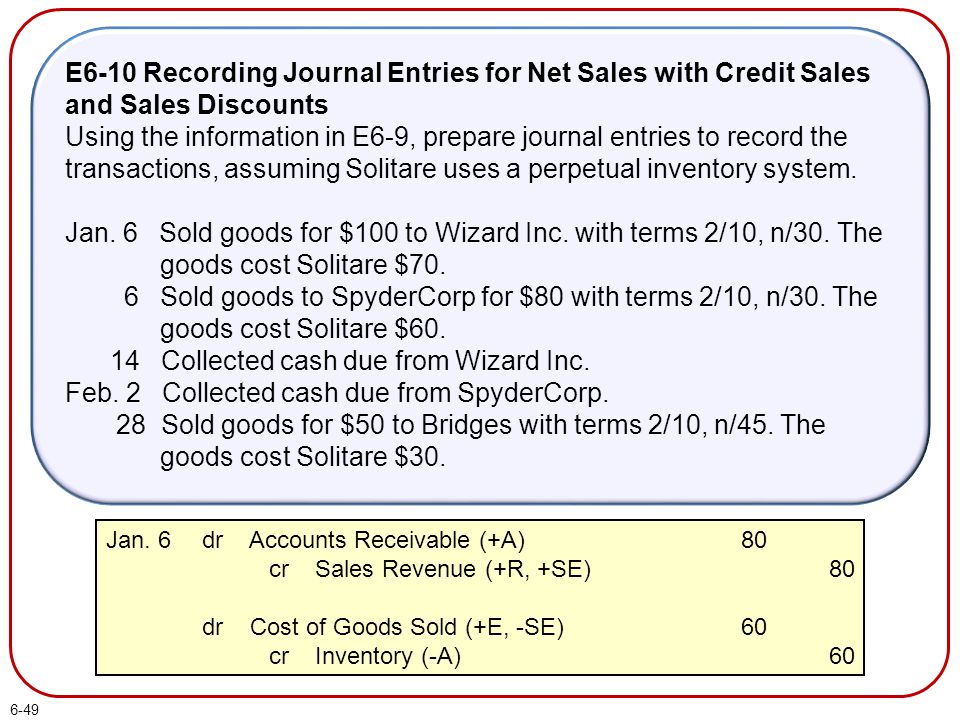

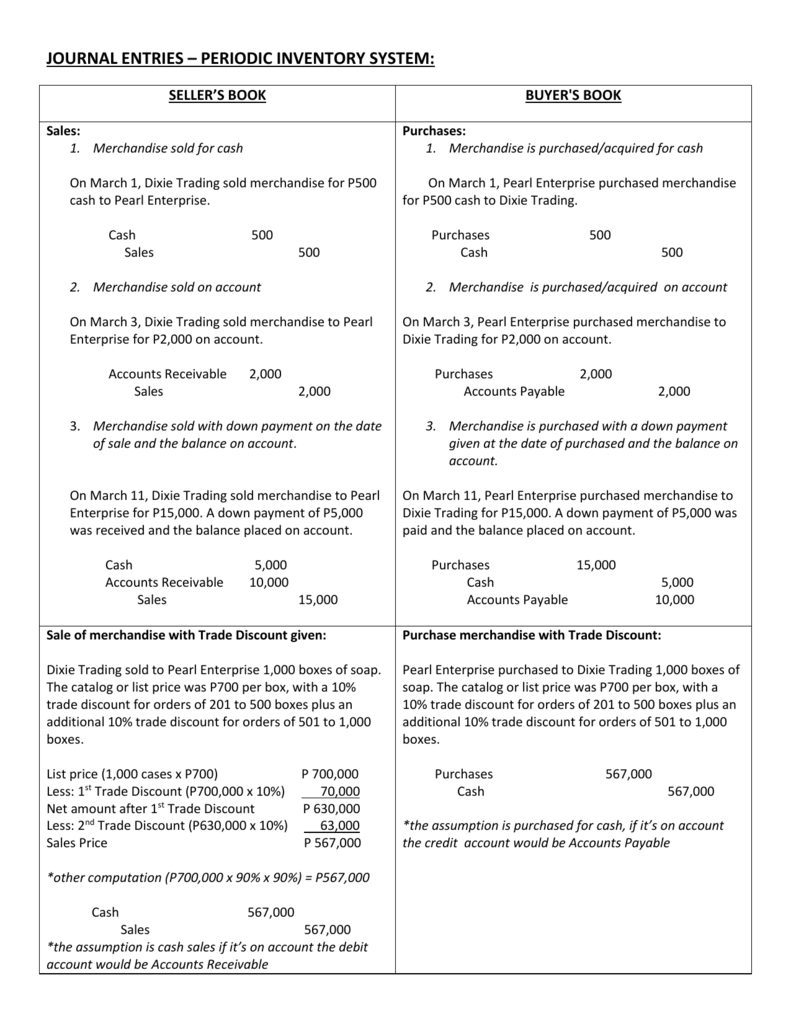

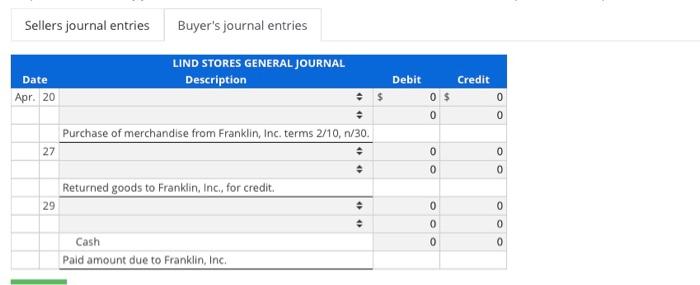

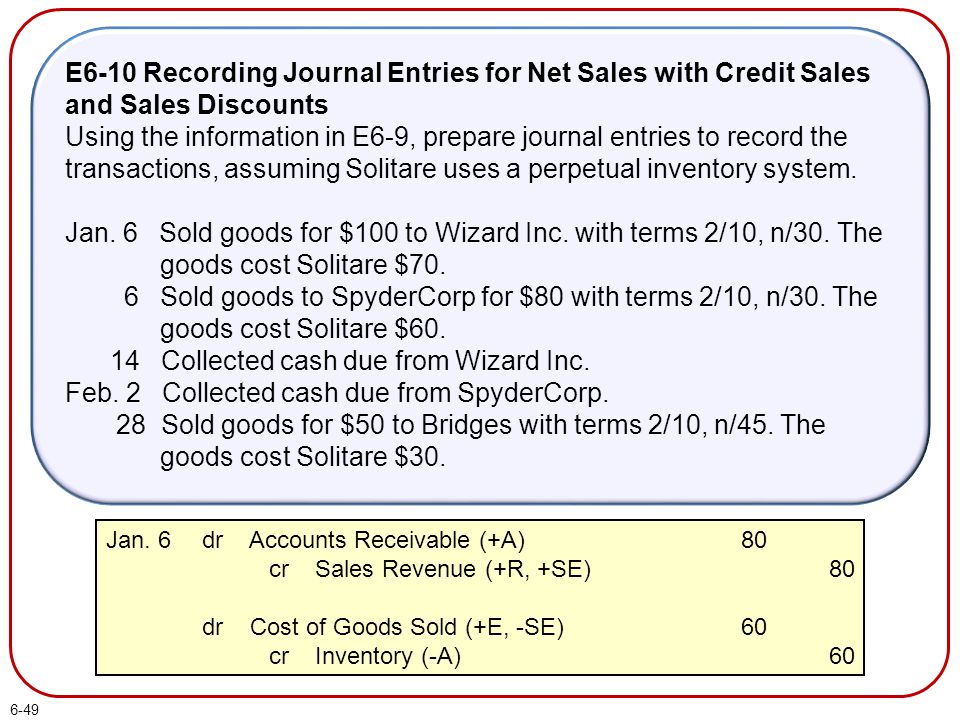

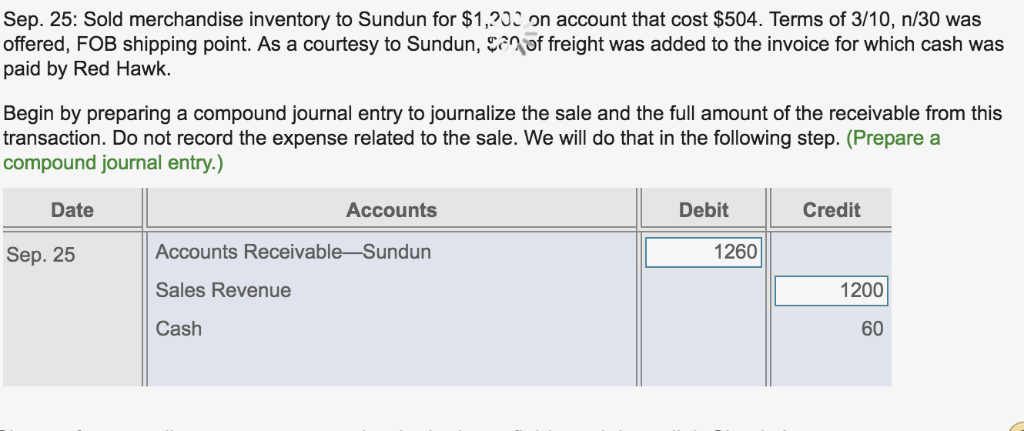

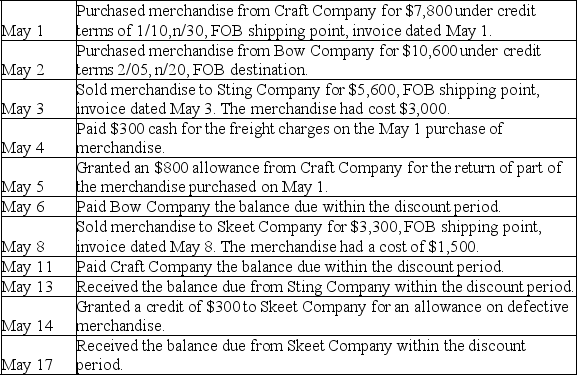

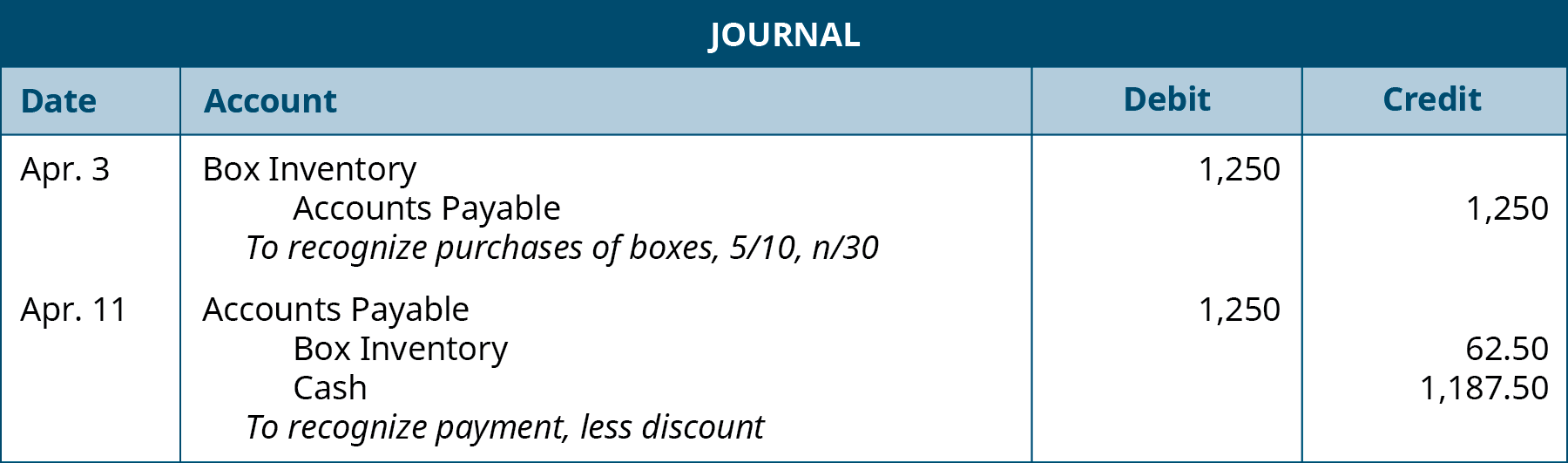

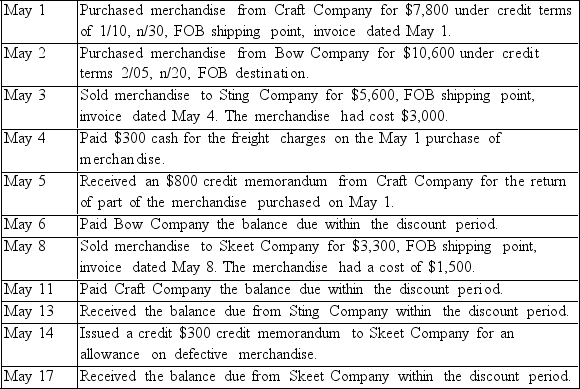

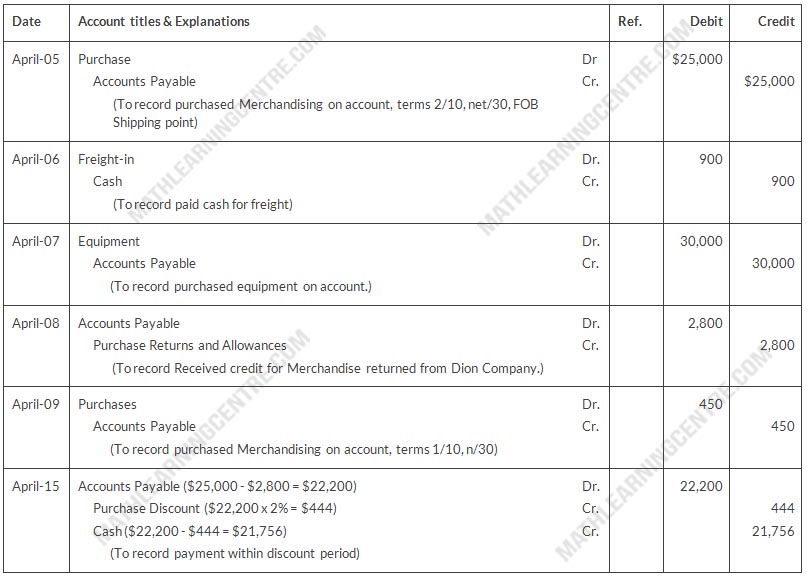

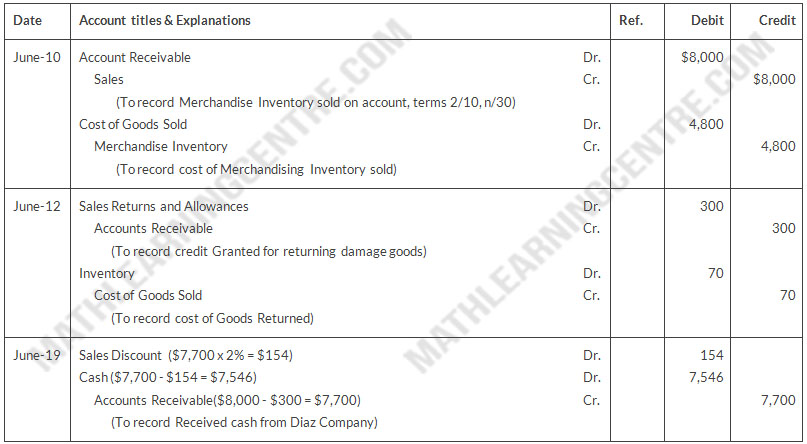

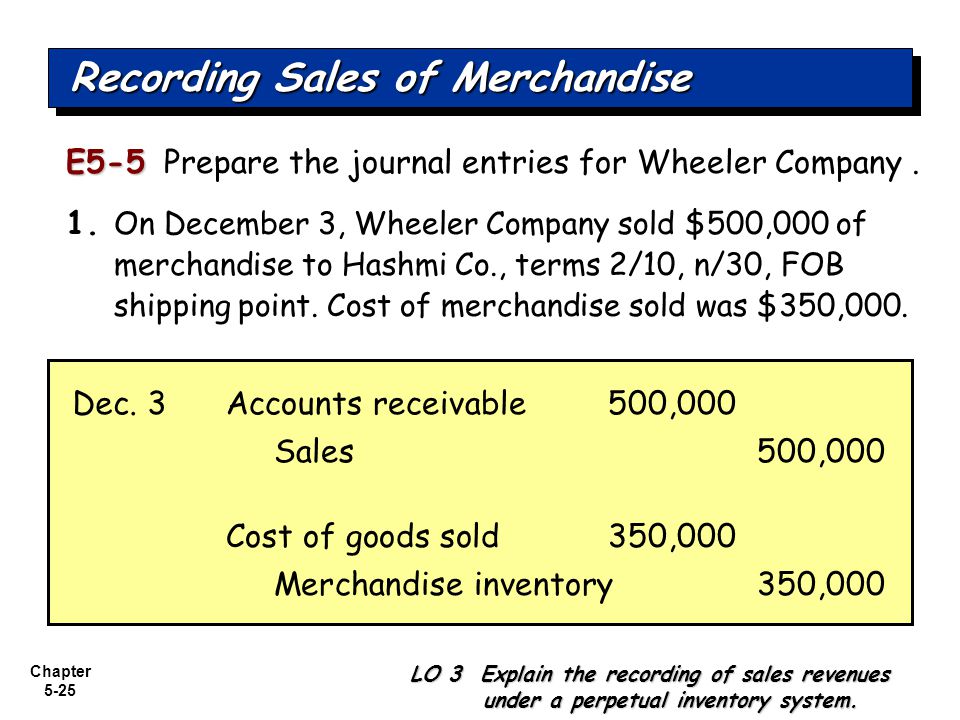

E52 (LO 2) Information related to Duffy Yachts is presented below Journalize purchase transactions**** 1 On April 5, purchased merchandise on account from Thomas Nautical Supply for £25,000, terms 2/10, net/30, FOB shipping point 2 On April 6, paid freight costs of £900 on merchandise purchased from Thomas 3 On April 7, purchased equipment on account for For example, the terms 2/10, n/30 means a 2% discount will be allowed if the payment is made within 10 days of the date of invoice, otherwise, the full amount is to be paid in 30 days Journal Entry for Cash Discount Cash discount is an expense for seller and income for buyer It is, therefore, debited in the books of seller and credited inComplete the journal entry to record the receipt of cash from the customer by selecting the account names from the dropdown menus and the Question A company sells merchandise on November 2 at a $4000 invoice price with terms of 2/10,n/30

Assignment Instructions Question – A company purchased $1,800 of merchandise on July 5 with terms 2/10, n/30 On July 7, it returned $0 worth of merchandise On July 28, it paid the full amount due Assuming the company uses a perpetual inventory system, and records purchases using the gross method, Compute the correct journal entry toBasics of Journal Entries Accounting Journal Entry Examples More Examples of Journal Entries Accounting Equation Double Entry Recording of Accounting Transactions Debit Accounts Intangibles Other than Goodwill InternalUse Software Website Development Costs 360 Property, Plant and Equipment2/10 n 30 journal entries vary depending on the accounting method used LIFO vs FIFO , accounting vs economic income , and many other matters make 2/10 n 30 accounting somewhat complicated Strong company policies must be in place to ensure smooth bookkeeping

Module Seven under 72 Module Seven Short Responses GC15 Lab Report for CHM45 In this experiment, insoluble cobalt carbonate CoCO3 is prepared by mixing solutions of cobalt chloride and sodium carbonate according to Equation 1She wants to evaluate the benefits of 2/10 net 30 terms of payment Details The invoice amount is $10,000 and 2/10 net 30 accounting is in place If paid within 10 days $10,000 X 98% = $9,800 due with in 10 days If paid within 30 days $10,000 is due Calculation Mary likes that she can receive a $0 value by paying her bill quickly Credit terms were 2/10, n/30 The inventory was sold on account for on jan 21 07 Credit terms were 1/10, n/30 The accounts payable was settled on jan 23, 07, and the accounts receivables were settled on jan 30, 07 Prepapre journal entries to record each of these transactions

Analyze And Record Transactions For The Sale Of Merchandise Using The Perpetual Inventory System Principles Of Accounting Volume 1 Financial Accounting

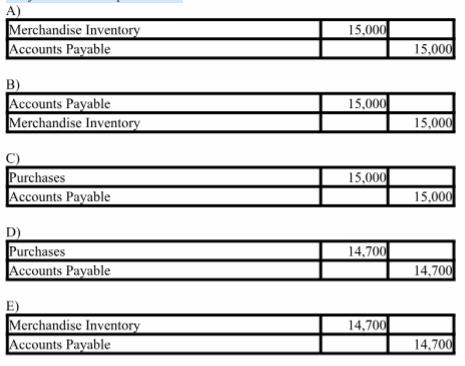

Morgan Inc Uses A Perpetual Inventory System And The Net Method Of Recording Purchases On May 12 A Merchandise Purchase Of 15 000 Was Made On Credit 2 10 N 30 The Journal Entry To

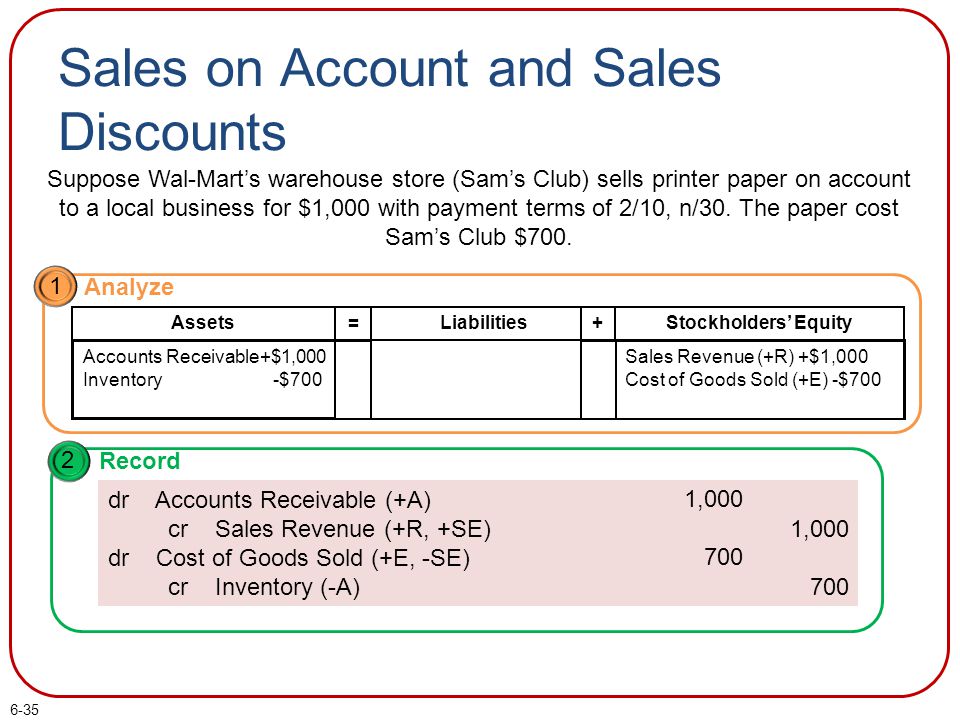

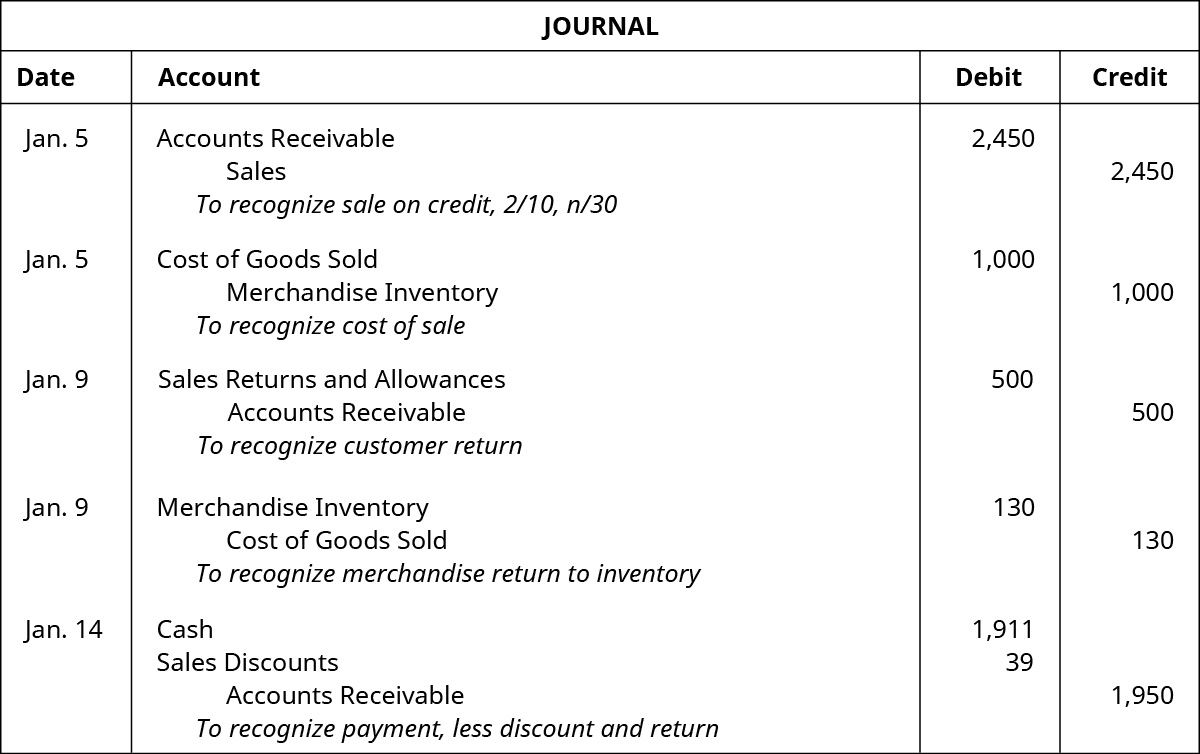

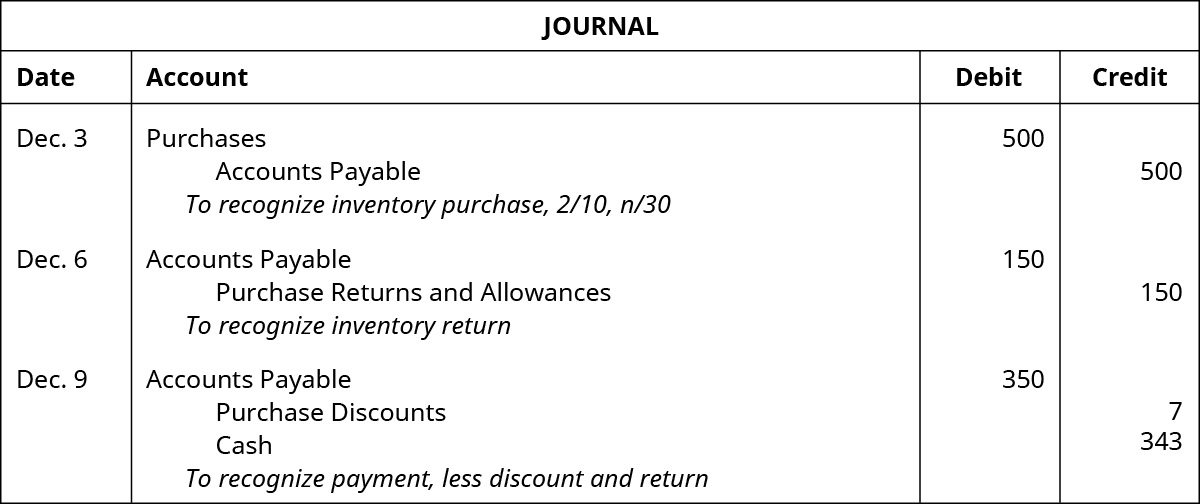

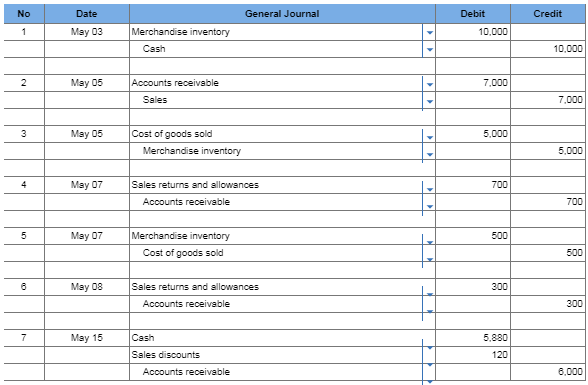

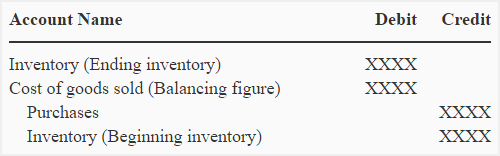

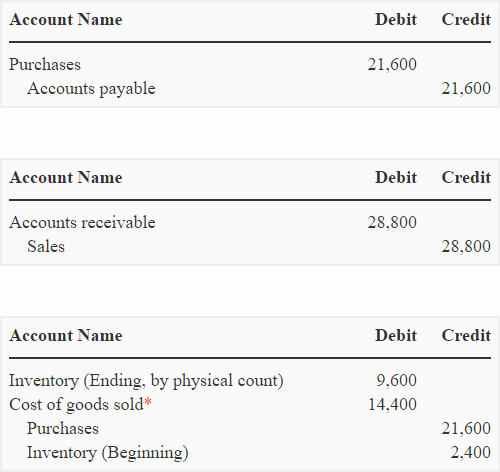

(2) Journal entries if periodic inventory method is used * 21,600 × 002 = $432 ** 21,600 432 = $21,168 « Prev March 25, returned 30 defective units from February 5 purchases to the supplier April 25 ,purchased for cash 500 units of merchandise at $ 19 per unit May 19 ,sold 750 units of merchandise for cash at a price of $0 per unit Q1 The entity sold merchandise at the sale price of $50,000 in cash The cost of merchandise sold was $30,000 Prepare a journal entry to record this transaction Journal Entry When merchandise is sold, two journal entries are recorded On Shilling Company sold merchandise in the amount of $5,800 to Anders, with credit terms of 2/10, n/30 The cost of the items sold is $4,000 Shilling uses the perpetual inventory system and the gross method The journal entry or entries

Financial Accounting For Undergraduates 3 E Chapter 5

Appendix Analyze And Record Transactions For Merchandise Purchases And Sales Using The Periodic Inventory System Principles Of Accounting Volume 1 Financial Accounting

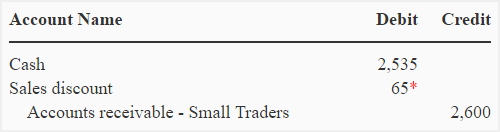

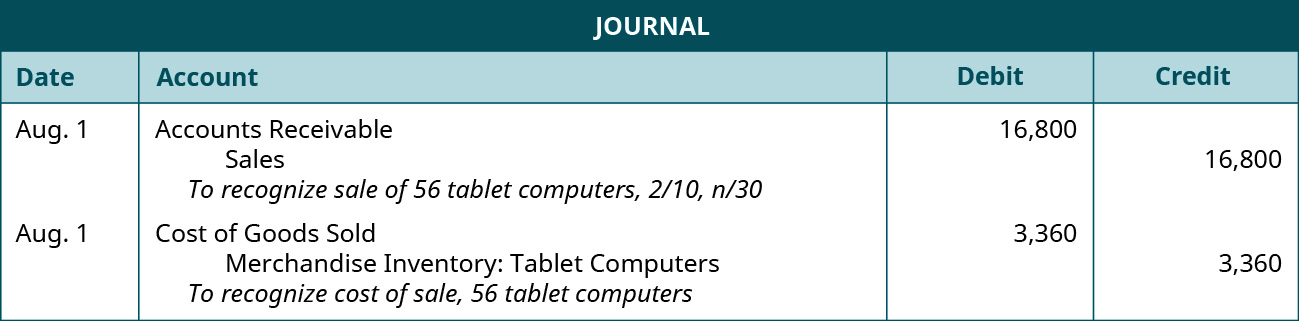

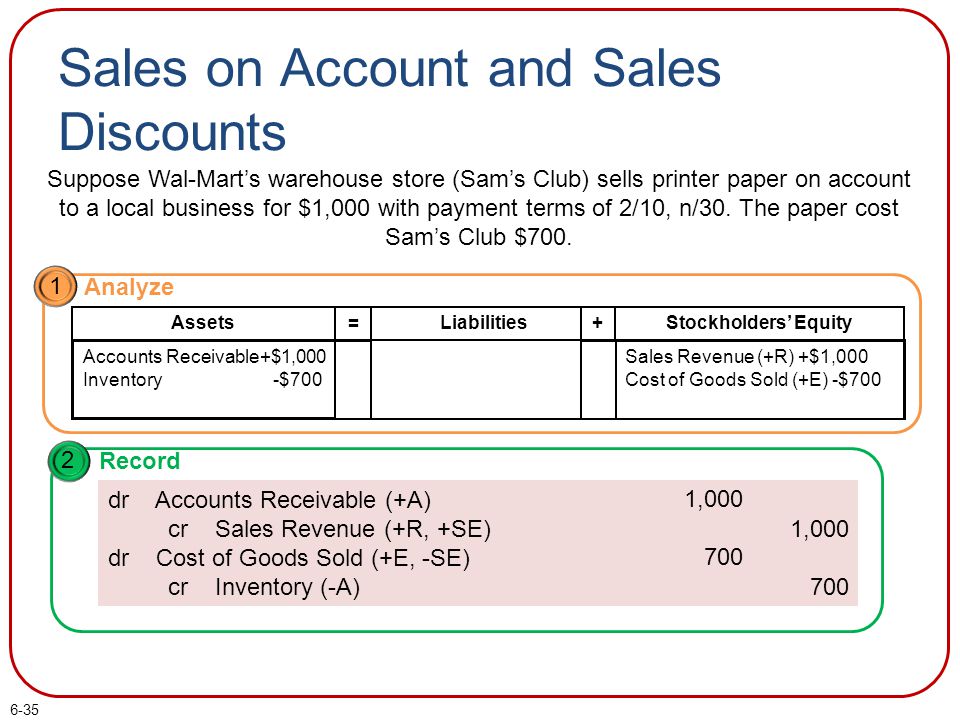

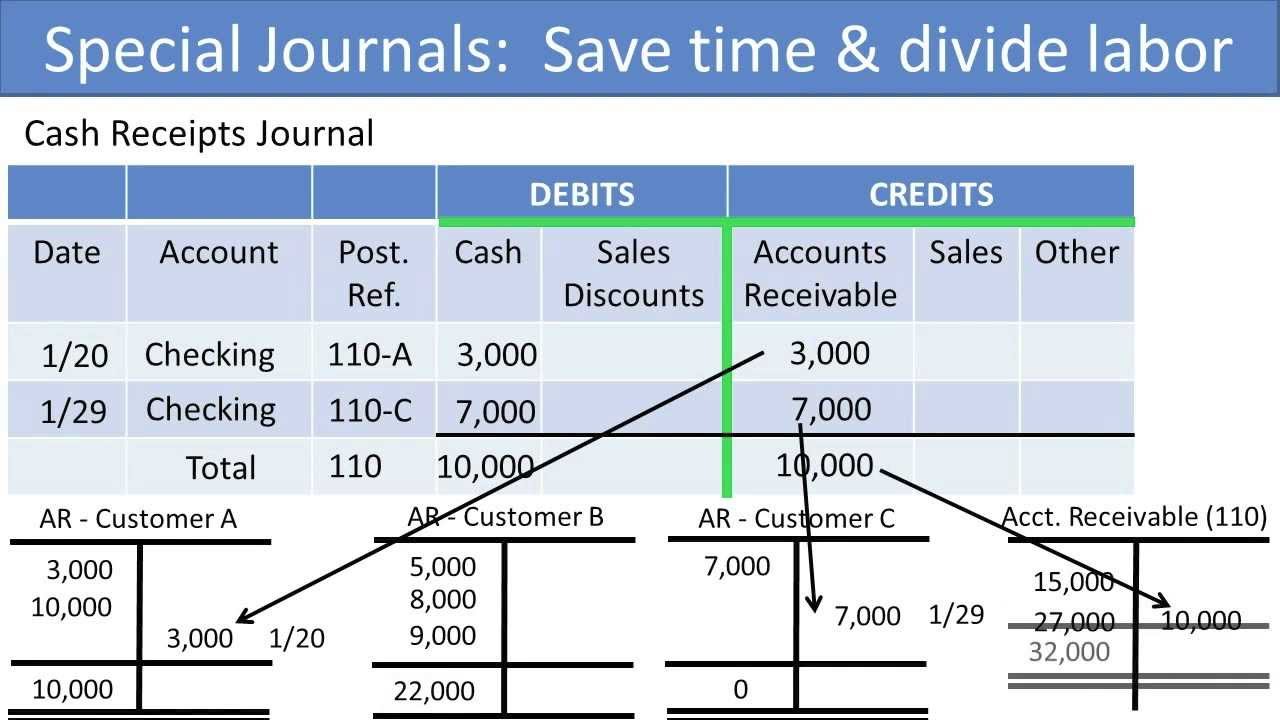

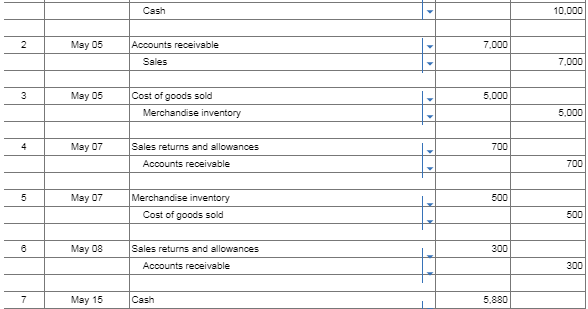

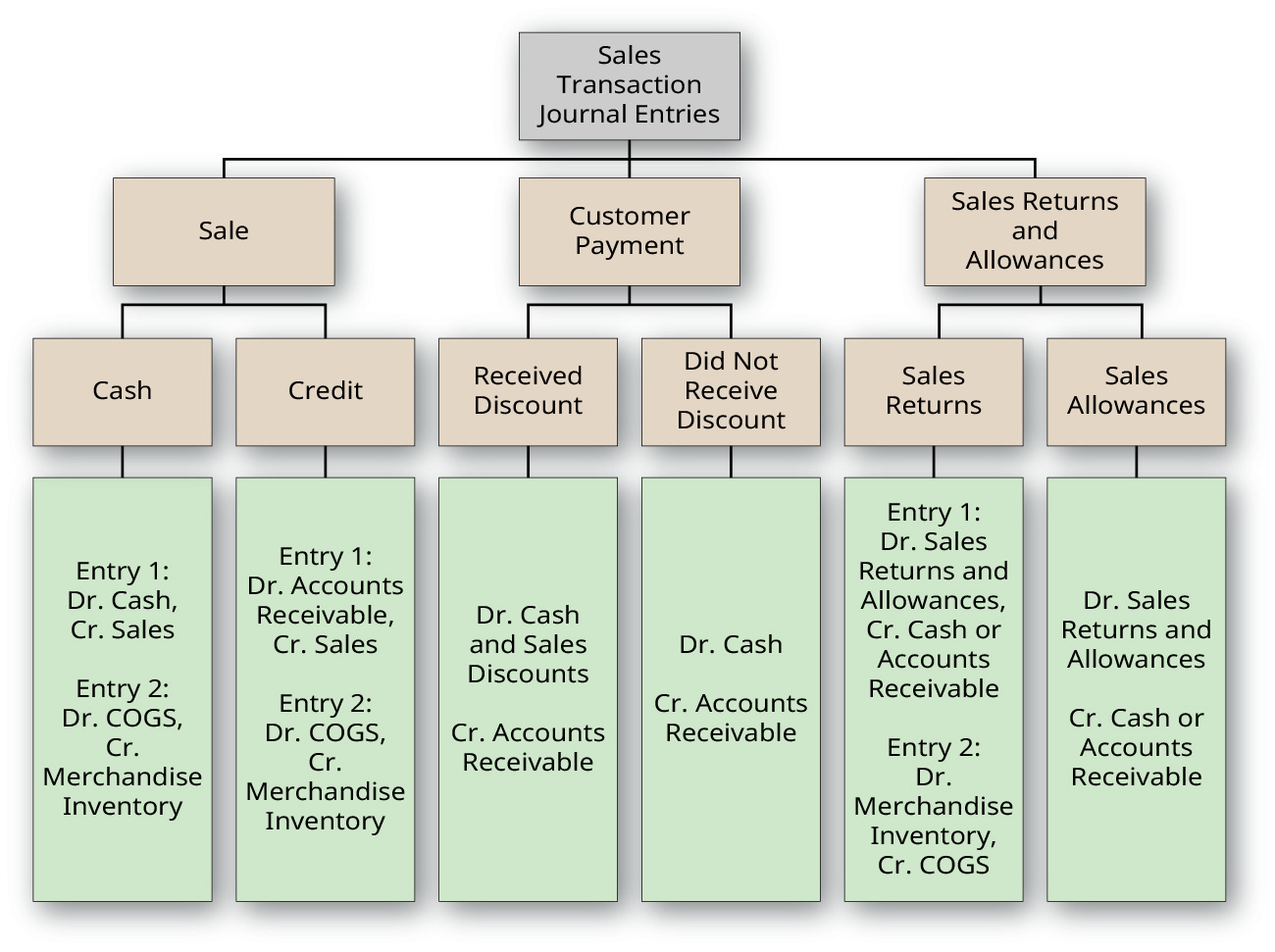

Sales Discount Transaction Journal Entries On August 1, a customer purchases 56 tablet computers on credit Terms are 2/10, n/30, and invoice dated August 1 The following entries occur On August 10, the customer pays their account in full The following entry occurs Journal Entry 30 In this activity, you'll experiment with one of two strategies intended to increase happiness The first was briefly described in the preceding text;Saber Company uses the perpetual inventory system Saber purchased merchandise on account with an invoice price of $8,000, terms 2/10,n/eom If Saber returns merchandise with an invoice price of $2,000 to the supplier, what should the journal entry to record the return include?

Accounting At Iba Pa Exercise 3 Journal Entries With Returns Partial Payment And Discounts Merchandising Business Facebook

1

Create journal entries for the following transactions 1 Purchased merchandise on account from Walker Supply for $60, terms 1/10, n/30 2 Sold merchandise onA Credit to Inventory of $2,000 b Credit to inventory of $1,000 July 1 Your Name Drug Store purchased medical supplies intended for sale for $1, from Vendor X Terms of sale 2/10, n/30, FOB Destination The freight charges = $5000 The journal entry is a debit to ___________ ( Gl Account name ) ?

Solved Exercise 228 Prepare Journal Entries To Record The Following 1 Answer Transtutors

Accounting At Iba Pa Exercise 3 Journal Entries With Returns Partial Payment And Discounts Merchandising Business Facebook

2/10 or 1/10 n/30 are discounts that offer an incentive for a customer to pay for purchases in a timely manner A company offering terms of 2/10 is offering a discount of 2% provided that the invoice is paid within 10 days This amounts to aJan's Jams makes a credit sale for $300 with terms of 2/10,n/30 The cost of the merchandise is $0 The required journal entry to record the sale and the cost of the sale is Business Answer Comment 1 answer Naily 24 1 year ago 7 0 Answer The complete journal entry would be Account Debit Credit Sales Revenue $300 Hunter's paradise sells merchandize on account to outdoor haven for $3,280, terms 2/10, n/30 what should the journal entry be to record this transaction

Recognition Of Accounts Receivable Gross And Net Method Explanation Journal Entries And Example Accounting For Management

Net 30 Terms Double Entry Bookkeeping

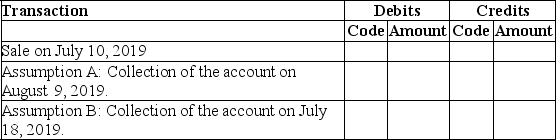

30 An item of merchandise with a list price of P 100 was purchased with a trade discount of 40% and credit terms of 2/10, n/30 If the vendor is paid within the discount period, the journal entry tc record the payment would be 41 Page Scanned by CamScannerGoods costing $2,000 are purchased on account on July 15 with credit terms of 2/10, n/30 On July 18 a $0 credit memo is received from the supplier for damaged goods Give the journal entry on July 24 to record payment of the balance due within the discount period using a perpetual inventory systemMerchandise with a sales price of $5,000 is sold on account with terms 2/10, n/30 The journal entry to record the sale would include a a debit to Cash for $5,000 b debit to Customer Refunds Payable for $100 c credit to Sales for $4,900 d debit to Accounts Receivable for $4,0

Illustrative Example Journal Entries For New Accounts

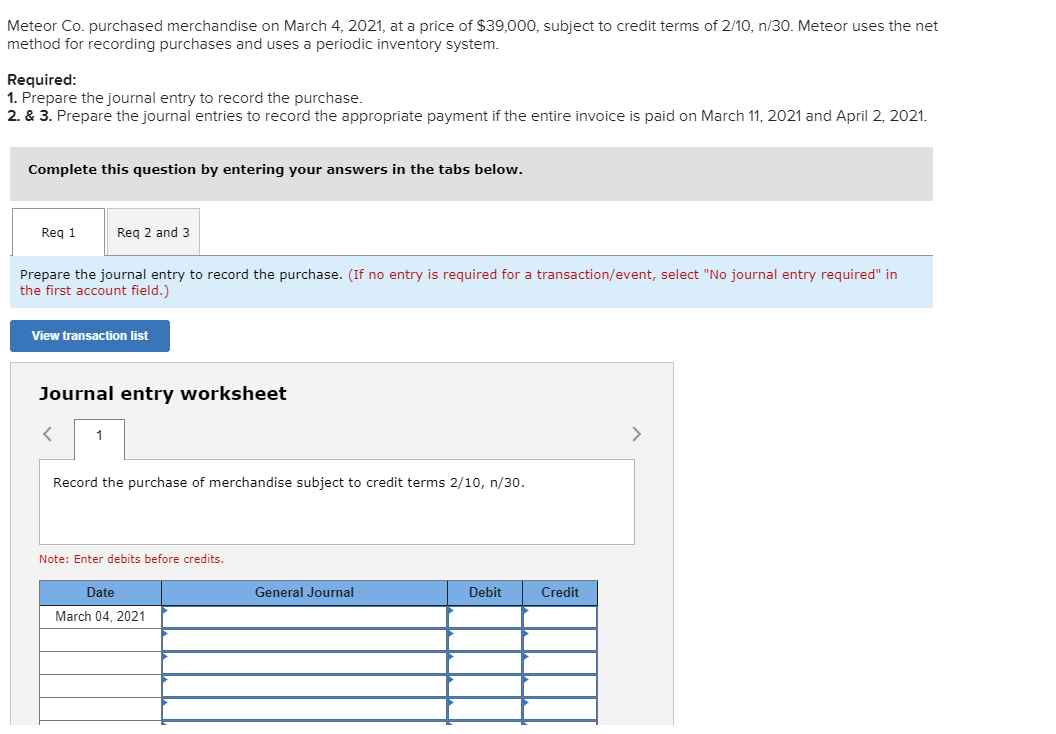

Solved Meteor Co Purchased Merchandise On March 4 21 At Chegg Com

Sales Discount Transaction Journal Entries On August 1, a customer purchases 56 tablet computers on credit The payment terms are 2/10, n/30, and the invoice is dated August 1 The following entries occur On August 10, the customer pays their account in full The following entryThe term 2/10, n/30 is a typical credit term and means the following "2" shows the discount percentage offered by the seller "10" indicates the number of days (from the invoice date) within which the buyer should pay the invoice in order to receive the discountFor example, the credit terms for credit sales may be 2/10, net 30 This means that the amount is due in 30 days (net 30) However, if the customer pays within 10 days, a

Solved Use The Following Information In A General Journal Using The Gross Price Method 6 Purchased 0 Of Merchandise On Account From Johnston Co Course Hero

He Following Are Selected Transactions Of Andreu Company Andreu Prepares Finan Cial Statements Quarterly Jan Purchased Merchandise On Account From Diego Company 30 000 Terms 2 10 N 30 Andreu Uses The Perpetual Inventory System

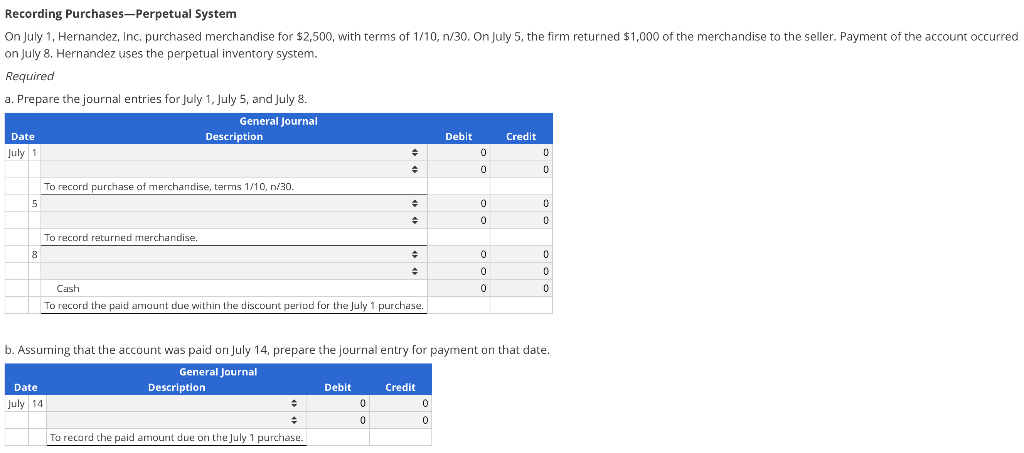

Sales Discount Example For example, if a business sells goods to the value of 2,000 on 25/10, n/30 terms, it means that the full amount is due within 30 days but a 25% sales discount can be taken if payment is made within 10 days The sales discount in this example is calculated as follows Sales price = 2,000 Sales discount % = 25% SalesRecall from Merchandising Transactions, that credit terms of 2/10, n/30 signal the payment terms and discount, and FOB shipping point establishes the point of merchandise ownership, the responsibility during transit, and which entity pays shipping charges Therefore, 2/10, n/30 means Sierra Sports has ten days to pay its balance due to receiveA company purchased $3,700 of merchandise on July 5 with terms 2/10, n/30 On July 7, it returned $850 worth of merchandise On July 12, it paid the full amount due Assuming the company uses a perpetual inventory system, and records purchases using the gross method, the correct journal entry to record the payment on July 12 is

Answered Journal Entries For Merchandise Bartleby

Solved Prepare The Journal Entries To Record The Following Transactions 1 Answer Transtutors

A) Accounts Payable, debit, $000;No Date General Journal;Sales Discount Transaction Journal Entries On August 1, a customer purchases 56 tablet computers on credit The payment terms are 2/10, n/30, and the invoice is dated August 1 The following entries occur On August 10, the customer pays their account in full The following entry

Accounting At Iba Pa Fob Destination Freight Prepaid Facebook

1

The most common discount term is 2/10, n/30 This means that if the vendor pays within 10 days of the invoice, it will get a 2 percent discount Otherwise, the net amount is due within 30 days The gross method assumes that the discount will not be taken and records the purchase without regard to the discount Let's take a look at an example40% and credit terms of 3/10, n/30 The vendor was paid within the discount period From the buyer's standpoint, which is the correct journal entry to record the payment? The following journal entry would be made in the books of Metro company to record the purchase of merchandise * Net of discount ($500 × 15) – $25 discount (2) On the same day, Metro company pays $3 for freight and $100 for insurance The following journal entry would be made to record the payment of freightin and insurance expenses (3)

Cost Of Goods Sold Journal Entries Video Lesson Transcript Study Com

Analyze And Record Transactions For The Sale Of Merchandise Using The Perpetual Inventory System Principles Of Accounting Volume 1 Financial Accounting

Question Knowledge Check 01 A buyer uses a periodic inventory system, and on December 5, it purchases $4,000 of merchandise on credit terms of 2/10,n/30 Complete the journal entry by selecting the account names from the dropdown menus and entering the dollar amounts in the debitor credit columns The journal entries required to record the purchase of merchandise under both the cases are discussed below When Merchandise Are Purchased for Cash If merchandise are purchased for cash, the accounts involved in the transaction are the purchases account and cash account The purchases account is debited and the cash account is creditedPurchases Discount, credit, $8600;

Prepare Journal Entries To Record Each Of The Following Sales Transactions Of A Merchandising Company The C Homeworklib

1

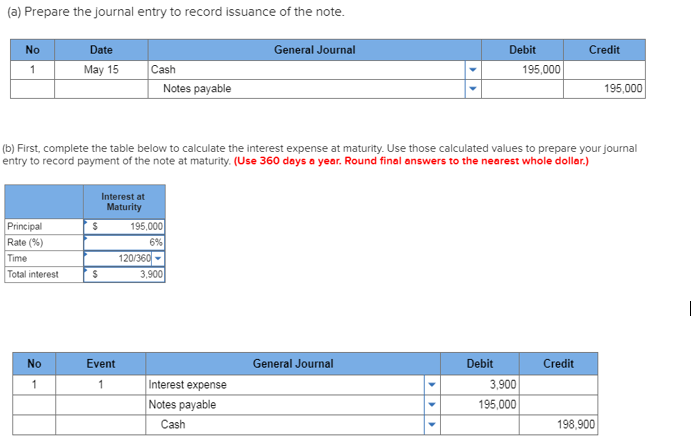

Net 30 terms or n/30 means that payment in full is due 30 days after the date of the invoice Net 30 terms are often combined with a cash discount for early settlement For example 2% 10 days, net 30 terms or 2/10, n/30 means, that a 2% discount can be taken if payment is made with 10 days, otherwise the full amount is due within 30 daysThe second is new Assignments similar to both of these have been employed with encouraging results in positive psychology classes at colleges

A Customer Who Is Given Credit Terms Of 2 10 N 60

On June 10 Pharoah Company Purchased 7 600 Of Merchandise From Cullumber Company Terms 4 10 N 30 Brainly Com

Chapter 7 Lecture

1

Wild Financial Managerial 6e Ch04

2 10 Net 30 Understand How Trade Credits Work In Business

Merchandising Activities Prezentaciya Onlajn

Internal Control Cash And Merchandise Sales Ppt Download

2 10 Net 30 Definition 2 10 Net 30 Calculation The Strategic Cfo

Solved Prepare Journal Entries To Record Each Of The Chegg Com

Solved Purchased Merchandise Inventory On Account From Chegg Com

Solution When A Company Is Given Credit Accounting

Acg21 Connect Ch 4

Internal Control Cash And Merchandise Sales Ppt Download

Accounts Payable Journal Entries Most Common Types Examples

Accounting For Merchandising Businesses Ppt Download

Special Journals Financial Accounting

Sales On Credit And Credit Terms Accountingcoach

Solved Prepare The Journal Entries To Record The Following Transactions On Monroe Company S Books Using A Perpetual Inventory System A On March Course Hero

Quiz On July 10 19 Rex Company Sold Merchandise At An Invoice Price

Solved Prepare The Journal Entries To Record The Following Transactions On Cullumber Company S Books Using A Perpetual Inventory System If No Ent Course Hero

Sales On Credit And Credit Terms Accountingcoach

Section 11 Revision

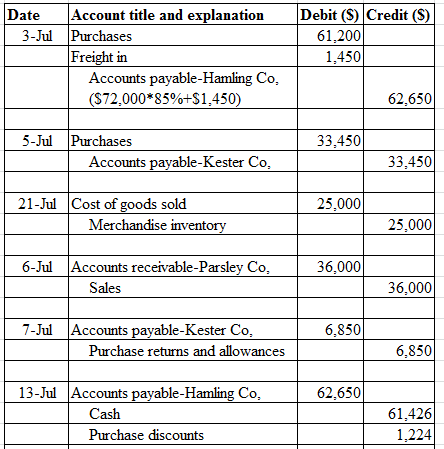

Answered July 3 Purchased Merchandise On Bartleby

Kidsinprisonprogram Files Wordpress Com

Accounting At Iba Pa Exercise 3 Journal Entries With Returns Partial Payment And Discounts Merchandising Business Facebook

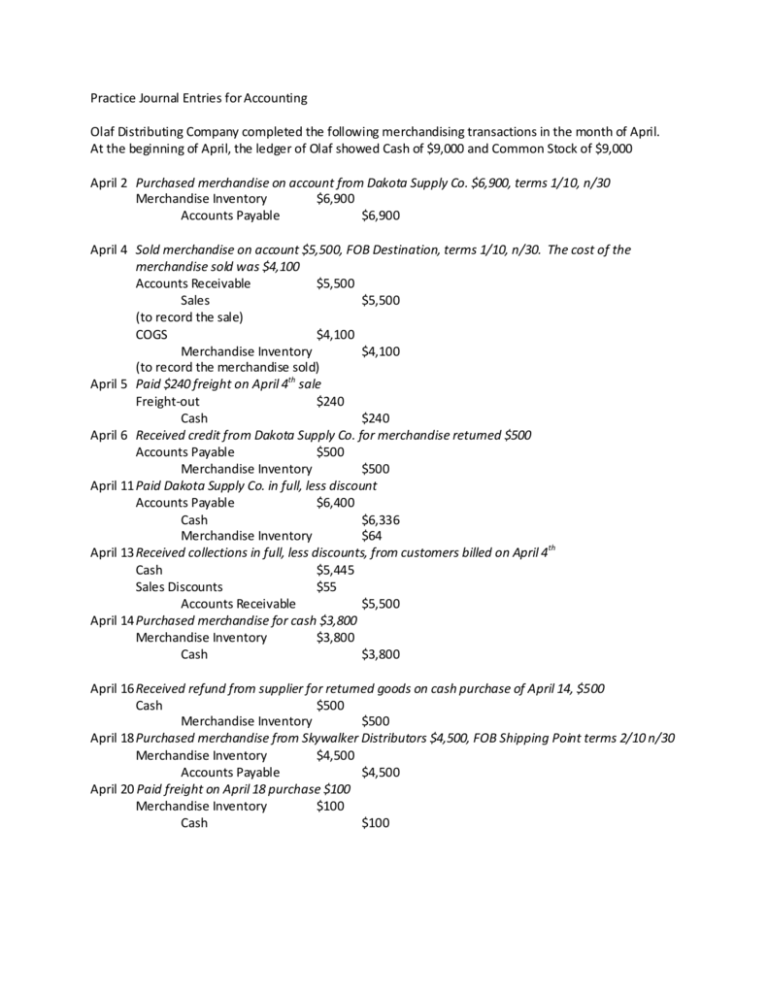

Practice Journal Entries For Accounting Olaf Distributing Company

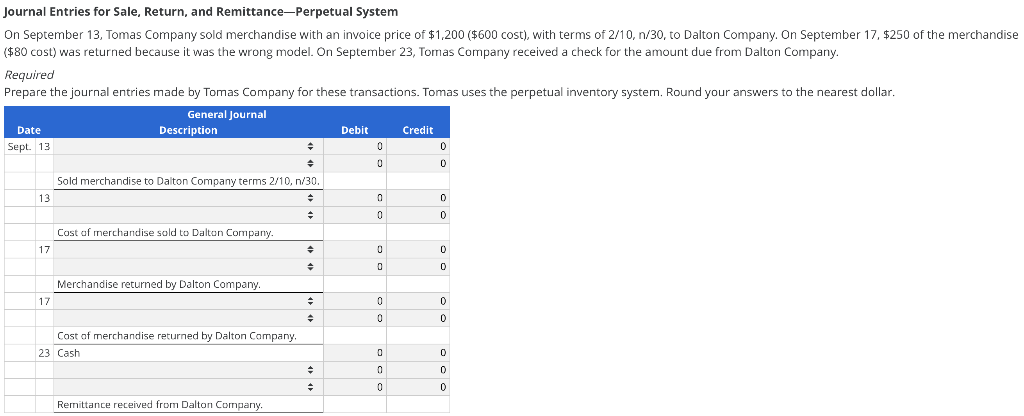

Solved Journal Entries For Sale Return And Chegg Com

Study Guide Chapter 5 Financial Pdf Free Download

Acg21 Connect Ch 4

Financial Accounting For Undergraduates 3 E Chapter 5

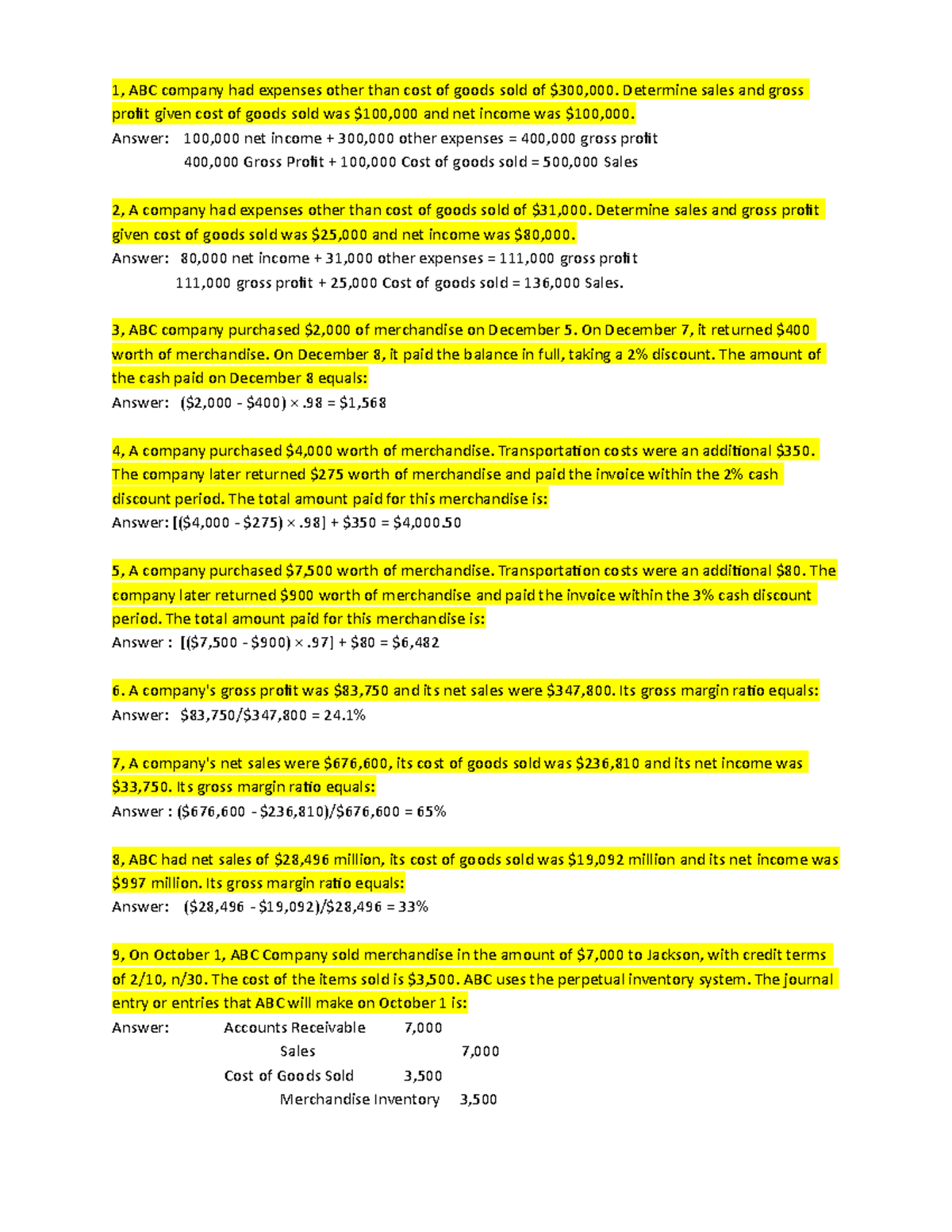

Exam 2 Practice Questions 1 Abc Company Had Expenses Other Than Cost Of Goods Sold Of 300 000 Studocu

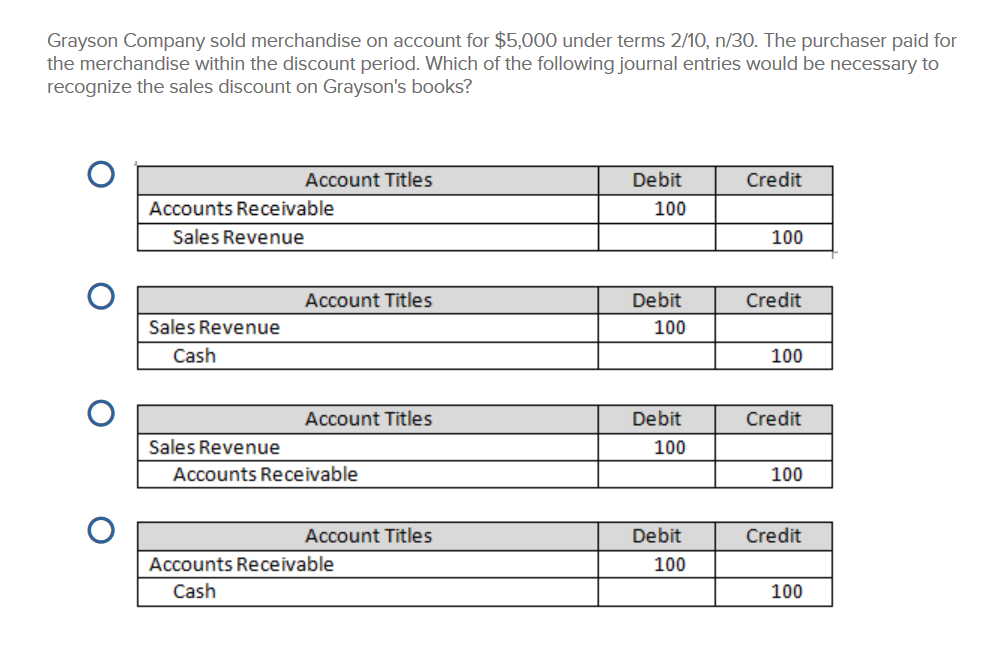

Solved Grayson Company Sold Merchandise On Account For Chegg Com

Sales On Credit And Credit Terms Accountingcoach

Solved Q15 Slinky Company Purchased Merchandise On June 10 Chegg Com

Solved Journal Entries For Sale Return And Chegg Com

Solved On June 10 Diaz Company Purchased 9 000 Of Merchandise From 1 Answer Transtutors

Accounts Payable Journal Entries Most Common Types Examples

Acg21 Connect Ch 4

J Company Purchased 1 800 Of Merchandise Clutch Prep

Merchandising Activities Prezentaciya Onlajn

Periodic Inventory System Explanation Journal Entries Example Accounting For Management

On July 2 18 Lake Company Sold To Sue Black Merchandise Having A Sales Price Of 9 400 Cost Brainly Com

Journal Entry For Cash Discount Finance Strategists

What Does 2 10 Net 30 Mean

Quiz Prepare Journal Entries To Record The Following Merchandising Transactions Of Margin

On September 12 Ryan Company Sold Merchandise In The Amount Of 8 400 To Johnson Company With Homeworklib

On March 12 Medical Waste Services Provides Services On Account To Grace Hospital For 11 000 Terms Homeworklib

Accounts Payable Journal Entries Most Common Types Examples

Analyze Journalize And Report Current Liabilities Principles Of Accounting Volume 1 Financial Accounting

Sales Discounts

Sundance Systems Has The Following Transactions During July July 5 Purchases 46 Lcd Televisions On Account Homeworklib

Analyze And Record Transactions For The Sale Of Merchandise Using The Perpetual Inventory System Principles Of Accounting Volume 1 Financial Accounting

Accounting For Merchandising Activities Lecture Ppt Download

Accounting For Merchandising Operations Ppt Download

Sales Discounts

Merchandising Activities Prezentaciya Onlajn

Accountingplus786 Blogspot Com

Solved Prepare Journal Entries To Record The Following Merchandising Transactions Of Margin Quiz

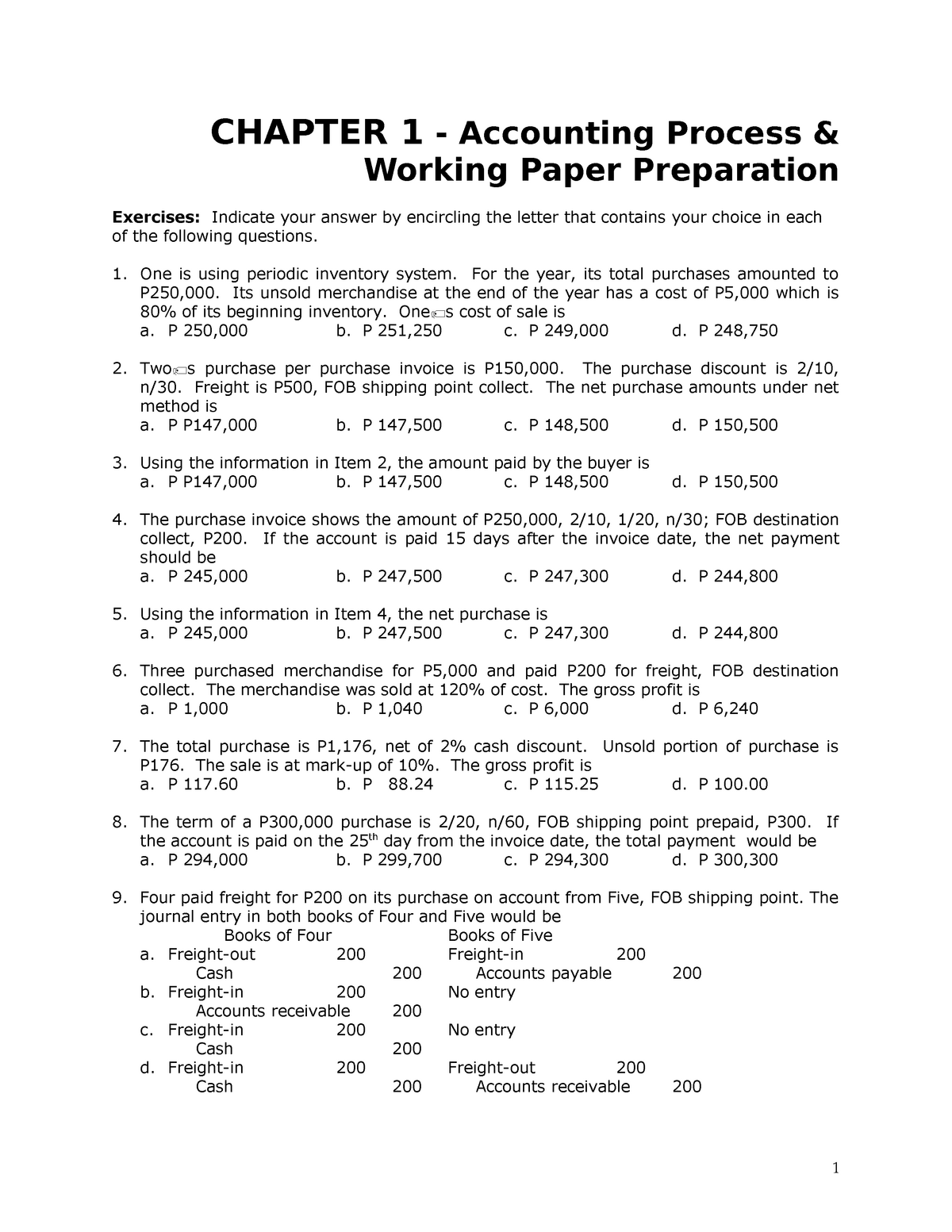

Accounting Cycle Accounting Process And Working Paper Preparation Studocu

Journal Entries For Merchandising Company Buyer Youtube

Solved Merchandise Costing 2 900 Is Sold For 3 900 On Chegg Com

Cost Of Goods Sold Journal Entries Video Lesson Transcript Study Com

Chapter 6 Merchandising Operations And The Multistep Income

Solved Oct12 Purchasedsomeinventoryonaccountfrompandapublishers 6 750 Terms2 10 N 30 Journal Entry Dr Merchandise Inventory 6 750 Cr Accounts Course Hero

Solved I Am Not Sure How Sold Merchandise On Account With Terms 2 10 N 30 Should Be Recorded I Believe Once Payment Has Been Received It Will Be Course Hero

Periodic Inventory System Explanation Journal Entries Example Accounting For Management

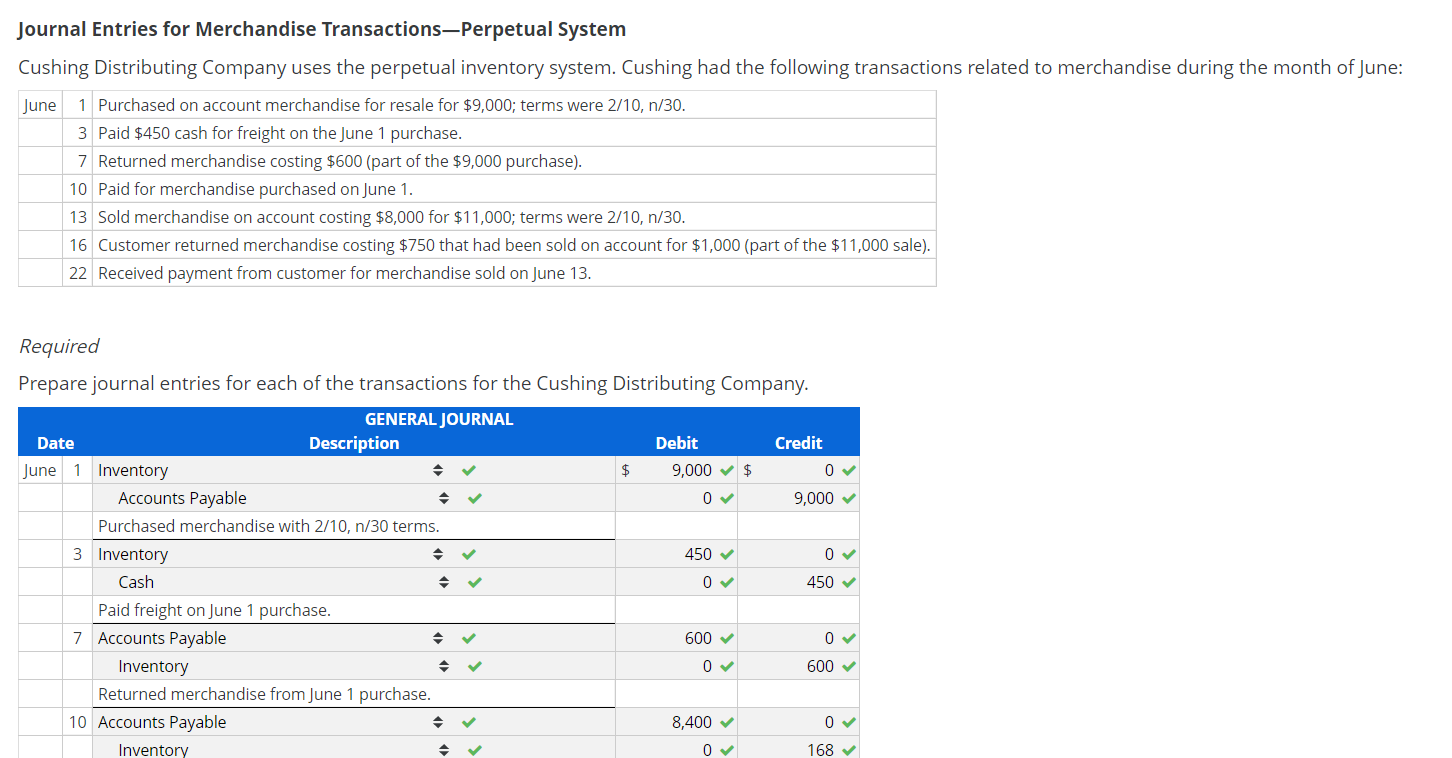

Answered Inventory 168 Cash 8 232 V Paid For Bartleby

This Information Relates To Nandi Co

Accountingplus786 Blogspot Com

A Credit Sale Of 3 700 Is Made On July 15 Terms 2 10 Get 1

Accounting For Merchandising Activities Lecture Ppt Download

On June 10 Diaz Company Purchased 8 000 Of Merchandise From Taylor Company

Accounting For Merchandising Operations Ppt Video Online Download

What Is 2 10 N 30 Definition Meaning Example

Accounts Payable Explanation Journal Entries Examples Accounting For Management

May 10 Purchased Goods Billed At 17 900 Subject To Cash Discount Terms Of 2 10 N 60 11 Homeworklib

Solved July 1 Purchased Merchandise From Boden Company For Chegg Com

I Need Help Answering This Question Knowledge Check U1 On April 10 Tyler Industries Purchased 22 000 Homeworklib

Lesson 7 9 Journal Entries Net Method Patrick Lee Msa

Answered May 1 Paid Rent For May 5 000 3 Bartleby

On December 28 21 Videotech Corporation Vtc Purchased 10 Units Of A New Satellite Uplink System Brainly Com